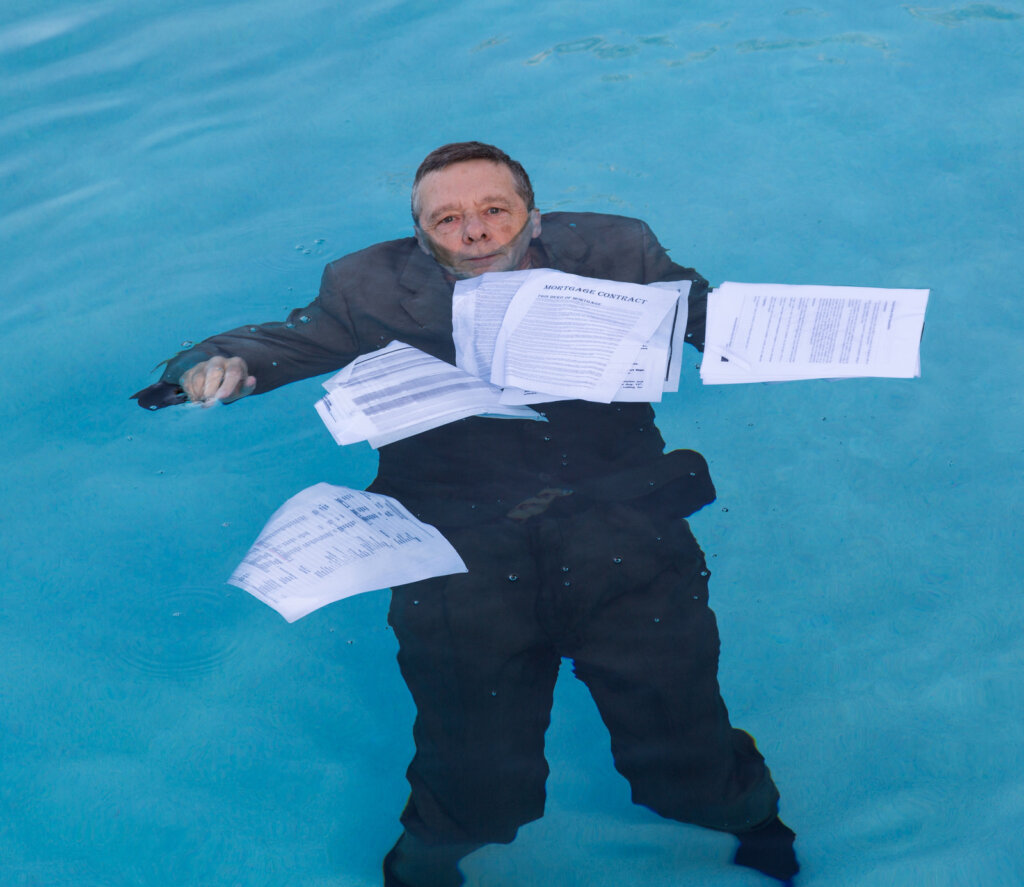

Sell my house fast in San Antonio if you feel like you’re drowning in payment arrears. Are you feeling overwhelmed and stressed because you’re behind in your house payments? You’re not alone. In fact, did you know that over 5 million Americans are behind on their mortgage payments? But don’t worry, because help is here. If you’re in San Antonio and need to sell your house fast, you’ve come to the right place. Selling your house quickly can alleviate the financial burden and give you the peace of mind you deserve. Whether you’re facing foreclosure, going through a divorce, or simply need to relocate,

Texas All Cash in San Antonio are here to assist you. Let’s explore the benefits of selling to a local cash home buyer and find the solution to your financial worries.

What if I’m Struggling to Pay my Mortgage?

If you’re struggling to pay your mortgage, consider reaching out to a local cash home buyer in San Antonio for assistance. They can provide you with strategies and financial assistance to help you through this tough time. Unlike traditional buyers, cash home buyers can offer you a quick solution to your financial problems. They understand the urgency of your situation and can provide you with a no-obligation cash offer for your home, regardless of its condition.

In addition to providing financial assistance, cash home buyers can also offer guidance and support in navigating the complexities of dealing with your mortgage. They can connect you with resources such as credit counseling, which can help you better manage your finances and explore options like loan modification or debt consolidation. These services can help you find ways to make your mortgage payments more manageable and potentially avoid foreclosure.

What’s the difference between Foreclosure and Repossession?

When you’re struggling to make your mortgage payments, it’s important to understand the difference between foreclosure and repossession. Foreclosure is a legal process in which the lender takes possession of your home due to defaulting on mortgage payments. This can have serious consequences, such as damaging your credit score and making it difficult to secure future loans. On the other hand, repossession typically refers to the lender taking possession of collateral when you default on a loan. While both involve the loss of property, foreclosure specifically pertains to your home.

Understanding the foreclosure timeline is crucial in preventing foreclosure. It typically begins when you miss a payment and can last several months, depending on the state you live in. During this time, you may have the option to pursue foreclosure alternatives, such as a short sale, where the lender agrees to accept less than what is owed on the mortgage. This can help you avoid the long-term consequences of a foreclosure.

If you find yourself behind on your mortgage payments, it’s important to take action to prevent foreclosure. Exploring options like a short sale or working with a foreclosure prevention specialist can help you navigate this challenging situation. Remember, there are alternatives to foreclosure, and with the right guidance, you can find a solution that works for you and your financial future.

How to get out of Debt

Are you wondering how to effectively get out of debt and regain control of your finances? If so, there are a few strategies you can consider to help you achieve debt relief and financial assistance. One option is debt consolidation, which involves combining all your debts into a single loan with a lower interest rate. This can make it easier to manage your payments and potentially save you money in the long run.

Another helpful tool is credit counseling, where you work with a professional who can provide guidance on creating a budget, managing your debts, and improving your financial situation. They can also negotiate with your creditors to lower interest rates or create a repayment plan that fits your budget.

Additionally, implementing budgeting tips can make a significant difference in your debt repayment journey. Creating a realistic budget and sticking to it can help you prioritize your expenses, cut unnecessary costs, and allocate more money towards paying off your debts.

What Process Should I Follow to Sell my House Fast in San Antonio?

To sell your house fast in San Antonio, follow a simple and efficient process with a local cash home buyer. When it comes to selling your house, you have several options. However, if you’re looking for a quick and hassle-free sale, selling to a cash home buyer is your best bet. The selling process with a cash home buyer is straightforward and can save you time and stress.

First, you’ll need to submit a property information form to the cash home buyer. This form will provide them with the necessary details about your house. Once they receive your information, they will assess your property and make a fair all-cash offer within 24 hours. Unlike traditional buyers, cash home buyers don’t require you to make any repairs or renovations. They buy houses in any condition.

Once you receive the cash offer, you can choose to accept or decline it. If you accept the offer, you can close on your timeline, as quickly as 7 days. This flexibility allows you to sell your house fast, without waiting for financing approval or dealing with a lengthy closing process.

To ensure a smooth selling timeline, it’s important to choose a reputable cash home buyer like Texas All Cash Home Buyers. They are experienced in the local real estate market and can provide you with a fair cash offer based on the market value of your house. They also cover all closing costs, so you don’t have to worry about any hidden fees.

Consider Alternative Selling Options

If you’re looking to sell your house fast in San Antonio, it’s important to consider alternative selling options that can provide you with a quick and hassle-free solution. As a struggling homeowner, you may be facing the pressure of missed mortgage payments and the fear of foreclosure. Instead of going through the traditional route of selling or renting, there are other options available to you.

One alternative is negotiating with lenders for a loan modification or repayment plan. This can help you avoid foreclosure and stay in your home. Another option is a short sale, where you sell your property for less than what you owe on the mortgage. This can be a viable solution if you’re unable to keep up with the payments and want to avoid foreclosure.

Selling your house fast to a local cash home buyer is another alternative worth considering. With this option, you can sell your house as-is, without the need for repairs or improvements. You can also avoid the hassle of listing your property on the market and dealing with realtor fees.

Frequently Asked Questions

Can a Cash Home Buyer Help Me if I’m Struggling to Pay My Mortgage?

A cash home buyer can help if you’re struggling with your mortgage. They offer mortgage assistance and provide selling options to prevent foreclosure. Sell your house fast and get the financial relief you need.

What Is the Difference Between Foreclosure and Repossession?

Foreclosure is when the bank takes your home due to missed mortgage payments. Repossession is when your financed item, like a car, is taken back. Foreclosure has more severe consequences than repossession. Avoid foreclosure by considering a short sale.

What Are Some Strategies to Get Out of Debt?

If you’re looking for strategies to get out of debt, consider debt consolidation, budgeting techniques, negotiating with creditors, increasing income opportunities, and seeking professional debt counseling. These options can help you regain control of your finances.

What Process Should I Follow to Sell My House Fast in San Antonio?

To sell your house fast in San Antonio, follow these steps: 1) Submit property info form. 2) Get fair cash offer in 24 hours. 3) Close as quickly as 7 days. No repairs or bank financing required. Trust Texas All Cash Home Buyers.

Are There Any Alternative Selling Options I Should Consider?

If you’re looking for alternative selling options and financial assistance, consider selling your house fast to a local cash home buyer. They can provide debt relief and offer a quick, no-obligation cash offer.

Conclusion

So there you have it, the solution to all your financial worries is just a phone call away. Don’t let the stress of being behind in your house payments consume you any longer. Sell your house fast in San Antonio to Texas All Cash . We Buy Houses San Antonio and say goodbye to repairs, realtor fees, and lengthy approval processes. It’s the easiest and most convenient way to get the peace of mind you deserve. Don’t wait any longer, take action today!